Bailout Helped Banks “Too Big to Fail” Get Bigger

Saturday, August 29, 2009

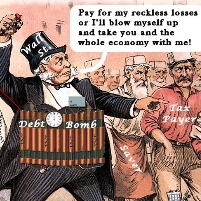

(graphic: notonecent.blogspot.com)

(graphic: notonecent.blogspot.com)

Is the flip side of “too big to fail” for the nation’s largest banks “too protected to change”? The decision by the federal government to prop up the likes of Bank of America, Citigroup, JPMorgan Chase and others did more than just shield the financial system from the calamity that was feared during last year’s economic crisis. It also has created an environment of endless risk-taking on the part of big banks which now have no motivation to play it safe if they know Washington will always come to the rescue. With the government guarding their back, bank executives can continue pushing the envelope, not only in terms of investment strategies, but ever-increasing institutional size and broadening control of the market.

J.P. Morgan, BofA and Wells Fargo each control 10% of all bank deposits currently in the United States—even though federal regulations forbid this kind of accumulation. Furthermore, these three financial behemoths, along with Citigroup, control 50% of the mortgage industry and two-thirds of all credit cards.

Camden Fine, president of the Independent Community Bankers of America, told David Cho of The Washington Post, “To favor one class of financial institutions over another class skews the market. You don't have a free market; you have a government-favored market. We will never have free markets again if you have the government picking winners and losers."

-Noel Brinkerhoff

Banks 'Too Big to Fail' Have Grown Even Bigger (by David Cho, Washington Post)

- Top Stories

- Unusual News

- Where is the Money Going?

- Controversies

- U.S. and the World

- Appointments and Resignations

- Latest News

- Can Biden Murder Trump and Get Away With it?

- Electoral Advice for the Democratic and Republican Parties

- U.S. Ambassador to Greece: Who is George Tsunis?

- Henry Kissinger: A Pre-Obituary

- U.S. Ambassador to Belize: Who is Michelle Kwan?

Comments